The Equifax Information Break: One of the largest credit reporting agencies in the United States, Equifax, disclosed a significant data breach in September 2017 that exposed the personal information of approximately 147 million people. The break, which had happened among May and July 2017, uncovered delicate information including Government backed retirement numbers, birth dates, addresses, and now and again, driver’s permit numbers. The Equifax data breach, its effects on customers and the business, and the lessons learned regarding data security and corporate responsibility are examined in this case study.

Background:

Organization Outline:

The Equifax Co.: Equifax is a global credit reporting agency with its headquarters in Atlanta, Georgia, and was established in 1899. Consumers and businesses can use its services for credit scoring, fraud detection, and credit information. Equifax is a major player in the financial ecosystem because it is one of the major credit bureaus.

Context of the sector: Credit reporting agencies are prime targets for cyberattacks because they collect and maintain a large amount of personal and financial data. The management of data breaches and the security of sensitive information present significant obstacles for the sector.

The Kind of Breach:

Timeline: The breach occurred in May and July of 2017, but it was not made public until September of that year. The public and regulatory scrutiny were aided by the delay in notification.

Data Outlined: Social Security numbers, birth dates, addresses, and driver’s license numbers were all compromised by the breach. This sort of information is especially important for wholesale fraud and extortion.

Response and Causes:

Specialized and Functional Disappointments:

Weakness Took advantage of: The break was credited to the double-dealing of a known weakness in Apache Swaggers, a generally utilized web application structure. Equifax had neglected to fix this weakness in spite of it being openly uncovered and a fix being accessible.

Inadequate Detection: Equifax’s inside security frameworks neglected to identify the break sooner rather than later. For several months, the breach went unnoticed, allowing attackers to access and extract sensitive data.

Management of Incidents:

Communication and Publication: Equifax was criticized for how it handled the breach, including how long it took to tell the public and those who were affected about it. The initial response from the company was criticized for not being transparent or clear.

Public and Administrative Reaction: The break prompted huge reaction from purchasers, controllers, and administrators. The Federal Trade Commission (FTC) and the Consumer Financial Protection Bureau (CFPB) conducted investigations into Equifax, and numerous lawsuits were filed against the company.

Impact:

Impact on Customers:

Fraud and theft of identities: Millions of people faced an increased risk of identity theft and financial fraud as a result of the disclosure of sensitive personal data. When customers’ personal information was made available on the dark web, they could face long-term consequences.

Reputation and confidence: Equifax’s reputation suffered greatly as a result of the breach, as did consumer trust. The company was criticized for its inadequate response and opaque approach to addressing the breach and providing assistance to those who were affected.

Corporate and Monetary Effect:

Costs to the budget: The breach resulted in significant financial expenses for Equifax, including remediation costs, legal settlements, and regulatory fines. Over $1.4 billion was estimated by the company as the breach’s total cost.

Authority Changes: Equifax’s leadership was altered as a result of the breach, including the resignation of CEO Richard Smith. To address the flaws revealed by the breach, the company reorganized its IT and security teams.

Legitimate and Administrative Results:

Regulatory Procedures:

Settlements and Penalties: 50 states and territories, the Federal Trade Commission, and the Consumer Financial Protection Bureau all agreed to a settlement with Equifax. Consumers affected by the breach were compensated as part of the $700 million settlement, which also provided funding for services like credit monitoring and identity theft protection.

Changes to regulations: Due to the breach, credit reporting agencies and other organizations that handle sensitive consumer data have received calls for more stringent security standards and stronger data protection regulations.

Consequences of legal action:

Lawsuits for Class Actions: Consumers and investors filed numerous class-action lawsuits against Equifax, seeking compensation for the harm caused by the breach. The legal proceedings made it clear that effective data protection procedures and accountability when handling sensitive information are required.

What We’ve Learned:

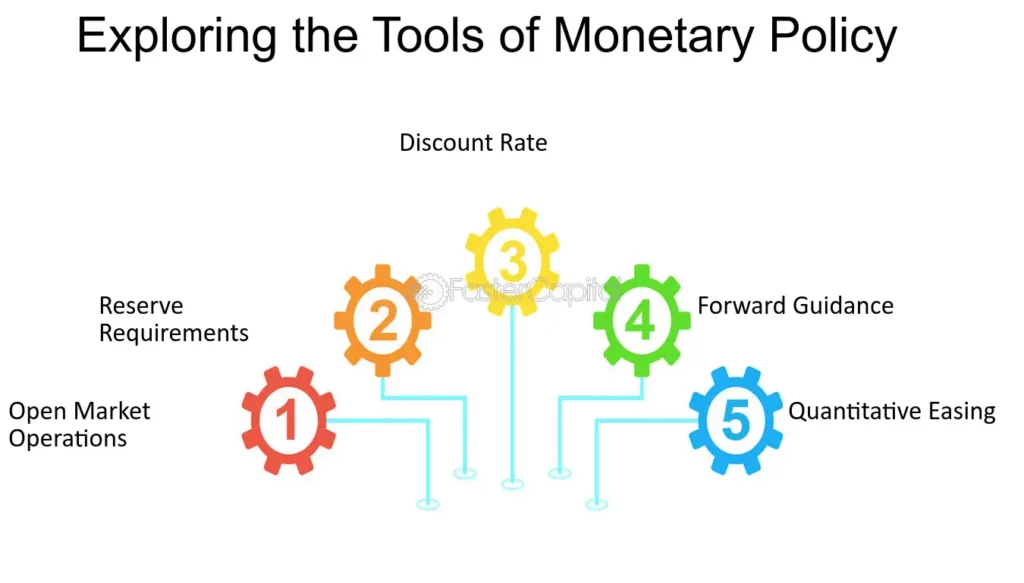

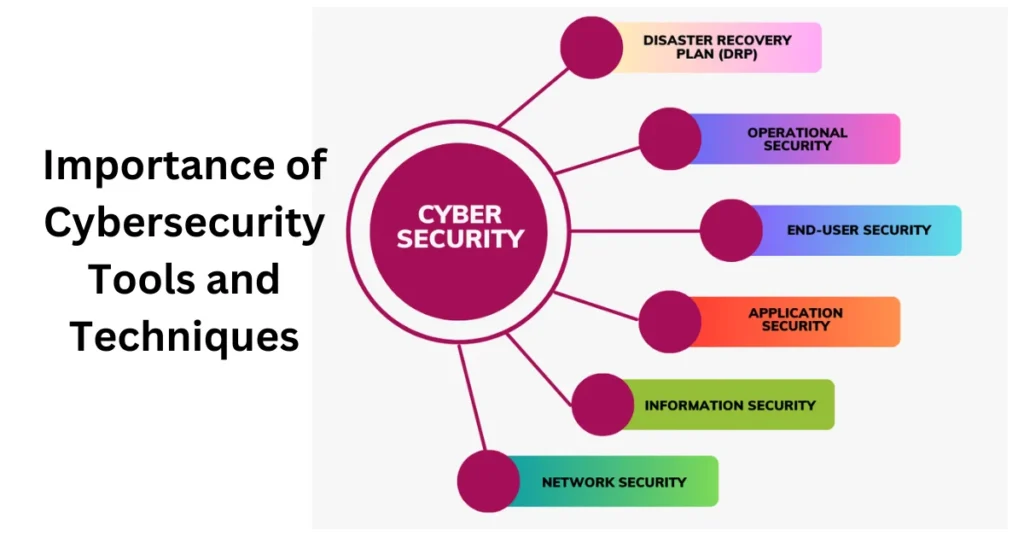

Cybersecurity’s significance:

Management of vulnerabilities proactive: The Equifax breach highlights the significance of timely vulnerability patching and proactive vulnerability management. Associations should focus on standard updates and security patches to safeguard against digital dangers.

Enhanced Response and Detection: In order to identify and mitigate data breaches, it is essential to have mechanisms for effective detection and response. Organizations that want to respond quickly to security incidents may benefit from putting in place sophisticated alert and monitoring systems.

Communication and openness:

Timely Communication: It is essential to promptly and transparently disclose data breaches in order to maintain consumer trust and facilitate efficient remediation. Associations ought to lay out clear correspondence conventions and give ideal updates to impacted people.

Customer Service: When dealing with the effects of a data breach, it is essential to provide affected individuals with comprehensive support and resources. Offering types of assistance, for example, credit observing and wholesale fraud insurance can assist with moderating the drawn out consequences for shoppers.

Governance and compliance with regulations:

Conformity to Standards: Consistence with information assurance guidelines and industry norms is fundamental for defending touchy data. Data security best practices and compliance with regulatory requirements should be prioritized by businesses.

Reputation and leadership: Solid administration and responsibility are fundamental for overseeing information security and answering breaks. To improve their overall security posture, organizations ought to make investments in cybersecurity governance and training.

Conclusion:

The Equifax data breach is a significant illustration of the difficulties associated with regulatory compliance, corporate responsibility, and data security. Effective cybersecurity measures, prompt incident response, and open communication with affected individuals were brought to light by the breach. Organizations looking to improve their data protection procedures and manage the risks associated with handling sensitive consumer information can benefit from the lessons learned from Equifax’s experience. The Equifax breach serves as a reminder of the need for vigilance, preparedness, and dedication to protecting personal data as the digital landscape continues to change.

GIPHY App Key not set. Please check settings