The consolidation of Run and T-Versatile, settled in April 2020, was quite possibly of the main telecom consolidations in U.S. history. The industry’s competitive landscape was transformed by this $26 billion merger of the third and fourth largest wireless carriers in the United States. This contextual analysis investigates the inspirations driving the consolidation, the administrative difficulties it confronted, and the ramifications for customers, contenders, and the more extensive market.

Before the merger, the US wireless industry as a whole:

Market Organization: The U.S. wireless market was dominated by four major carriers prior to the merger: T-Mobile, Sprint, Verizon, and AT&T. T-Mobile and Sprint came in last place in terms of market share, followed by Verizon and AT&T.

Dynamics of Competition: T-Portable, under the authority of President John Legere, had proactively started to disturb the business with its “Un-transporter” system, offering inventive plans and estimating that pulled in clients from its opponents. On the other hand, Sprint struggled financially and with network issues, making it difficult for it to compete effectively.

Disputes Between Sprint and T-Mobile Prior to Merger:

Sprint’s Obstacles: Due to its high debt load, declining customer base, and subpar network, Sprint faced significant financial difficulties. Regardless of endeavors to revive the organization, including a progression of value cuts and advancements, Run kept on losing portion of the overall industry to its rivals.

T-Mobile’s expansion: In the years preceding the merger, T-Mobile had experienced rapid expansion as a result of its aggressive marketing and customer-friendly policies. T-Mobile, on the other hand, faced difficulties expanding its network coverage, particularly in rural areas, and competing with Verizon and AT&T’s size.

Cost savings and synergies:

Economies of Scale: The promise of the merger was to save a lot of money through economies of scale, which would enable the combined company to lower operational costs, improve service quality, and optimize network infrastructure. The new T-Mobile was anticipated to benefit from these savings by making it easier for it to compete with Verizon and AT&T. Network Integration: The goal of the merged company was to create a 5G network that was more robust and extensive by combining T-Mobile’s network and Sprint’s spectrum assets. Competitive Positioning: This integration was seen as essential for competing in the emerging 5G market and improving customer service across the United States.

Taking on the Leaders of the Industry: By combining resources, the new T-Mobile aimed to accelerate its growth and innovation, offering consumers more choice and better service. The merger was positioned as a means for T-Mobile and Sprint to create a stronger competitor for Verizon and AT&T.

Consolidation of Markets: The four major wireless carriers in the United States were reduced to three by the merger. The businesses argued that the combined entity would have the scale and resources to drive competition in new areas, particularly 5G, despite concerns about reduced competition. 5G Leadership:

Streamlining 5G Implementation: Both Run and T-Versatile had made critical interests in 5G innovation, however neither had the assets to fabricate a cross country 5G organization all alone. The merger was viewed as a means of combining their resources and accelerating the nationwide rollout of 5G, giving them an advantage in the race for 5G leadership.

Regulatory Issues:

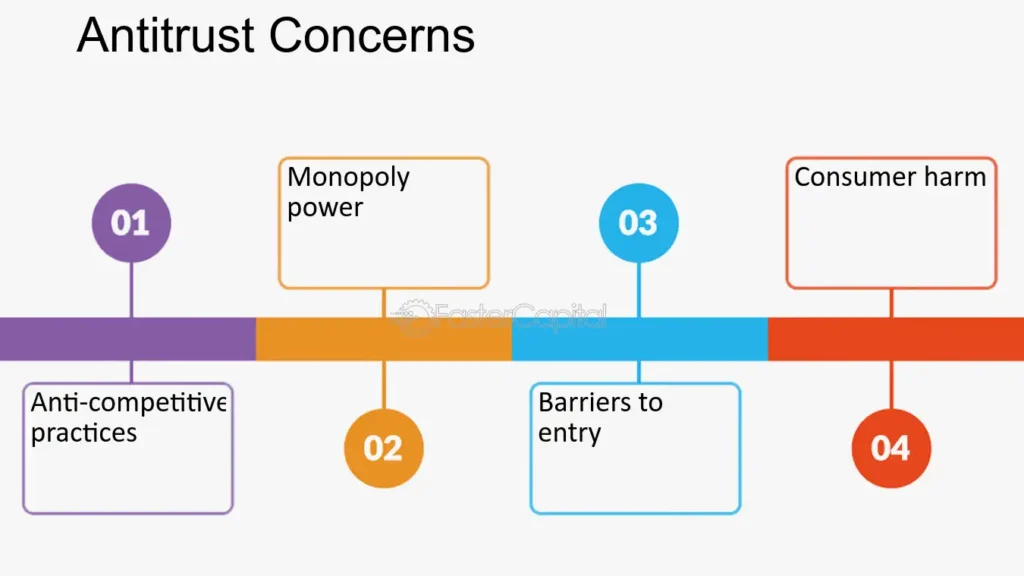

Concerns About Antitrust:

Examining by DOJ and FCC: The merger was closely scrutinized by the Federal Communications Commission (FCC) and the Department of Justice (DOJ), both of which were concerned about the merger’s potential impact on wireless market competition. Critics argued that reducing the number of major carriers from four to three could result in increased costs, decreased innovation, and fewer options for customers.

Lawsuit by the State Attorneys General: A coalition of state attorneys general filed a lawsuit to block the merger, arguing that it would harm consumers by reducing competition, in addition to federal scrutiny. The claim was one of the greatest deterrents to the consolidation, and its result was dubious for a large part of the consolidation interaction.

Restrictions and Conditions:

Divestitures and Responsibilities: T-Mobile and Sprint agreed to a number of divestitures and commitments to address antitrust concerns. This included promises to maintain price levels for three years and expand rural coverage, as well as the sale of Sprint’s prepaid brand Boost Mobile to Dish Network.

The emergence of a brand-new rival: As a feature of the consolidation understanding, Dish Organization was situated to turn into another fourth rival in the U.S. remote market. In an effort to maintain industry competition, Dish agreed to construct its own 5G network using Sprint assets.

Impact of the Merger:

Market Effect:

Increased Competitorship: With enhanced network capabilities and increased financial resources, the new T-Mobile was able to continue its aggressive pricing and innovative service offerings, driving market competition. Post-merger, the new T-Mobile emerged as a stronger competitor to Verizon and AT&T.

Effects on Customers: The consolidation’s effect on shoppers has been blended. Even though T-Mobile has expanded its 5G network and maintained competitive pricing, there are still concerns regarding the long-term effects on service quality and pricing, particularly as the market adjusts to having one less major carrier.

Expansion of the 5G Network:

Accelerated 5G Expansion: The new T-Mobile was able to accelerate its 5G network rollout thanks to the combined spectrum assets of Sprint and T-Mobile. T-Mobile quickly overtook Verizon and AT&T in terms of the number of cities and rural areas served by its 5G service.

Influence on the Market: As a result of T-Mobile’s expanded network, Verizon and AT&T were forced to accelerate their own 5G deployments, making the market for 5G in the United States more competitive as a result of the merger. The U.S. wireless industry’s innovation and investment have been sparked by this competition.

Dish Network’s Obstacles:

Building Another Organization: In order for Dish Network to become a viable fourth competitor, it had to overcome significant obstacles in building its own 5G network. The business has had to make significant infrastructure investments and deal with the challenges of entering a market dominated by established players.

The Competition’s Future: Although Dish’s entry into the market was intended to maintain competition, its success in the long run is still uncertain. If the merger ultimately benefits consumers, the company’s capacity to compete effectively with the three major carriers will be crucial.

What We’ve Learned:

Market Dynamics and Oversight by Regulators:

Consolidation and Competition in Balance: The difficulties of balancing market consolidation with the need to maintain competition were brought to light by the merger of Sprint and T-Mobile. While mergers have the potential to strengthen rivals, they also run the risk of reducing the number of market participants, which could be detrimental to customers.

Regulatory Agencies’ Functions: The merger’s regulatory process demonstrated the significance of vigilant oversight and the requirement for conditions that limit the potential negative effects on competition. The final terms of the merger were significantly influenced by regulators from both the federal and state levels.

Vital Consolidations in a Quick Evolving Industry:

Adapting to Changes in the Industry: Rapid technological advancements and shifting consumer demands define the wireless industry. The merger of Sprint and T-Mobile shows how businesses can use strategic mergers to adapt to these changes and position themselves for growth and leadership in emerging markets like 5G in the future. While consolidations offer open doors for development, their prosperity relies upon powerful execution. As demonstrated by T-Mobile’s successful integration of Sprint, the integration of networks, cultures, and operations is crucial to realizing the promised benefits of a merger.

Conclusion:

In the U.S. telecommunications industry, the merger of Sprint and T-Mobile was a game-changer that reshaped the competitive landscape and set the stage for the next era of wireless technology. By combining their resources, Sprint and T-Mobile aimed to strengthen their rivalry with Verizon and AT&T, speed up the rollout of 5G, and encourage market innovation. In the end, the merger resulted in a more formidable competitor in the industry, despite the fact that it was met with significant regulatory hurdles and raised concerns about competition. The outcome of the consolidation will keep on being estimated by its effect on customers, the cutthroat elements of the business, and the eventual fate of 5G in the US.

GIPHY App Key not set. Please check settings